尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

With Christmas just a couple of days away, it’s a good time to take stock of the shopping season. I think a fair bit about the luxury retail market, because where the rich lead, the market — and even the economy as a whole — tends to follow. This past year was the worst for the luxury industry since the great recession of 2007-09.

圣诞节即将来临,现在是回顾购物季的好时机。我经常思考奢侈品零售市场,因为富人的消费趋势往往会引领市场,甚至影响整个经济。今年是自2007-09年大衰退以来奢侈品行业最糟糕的一年。

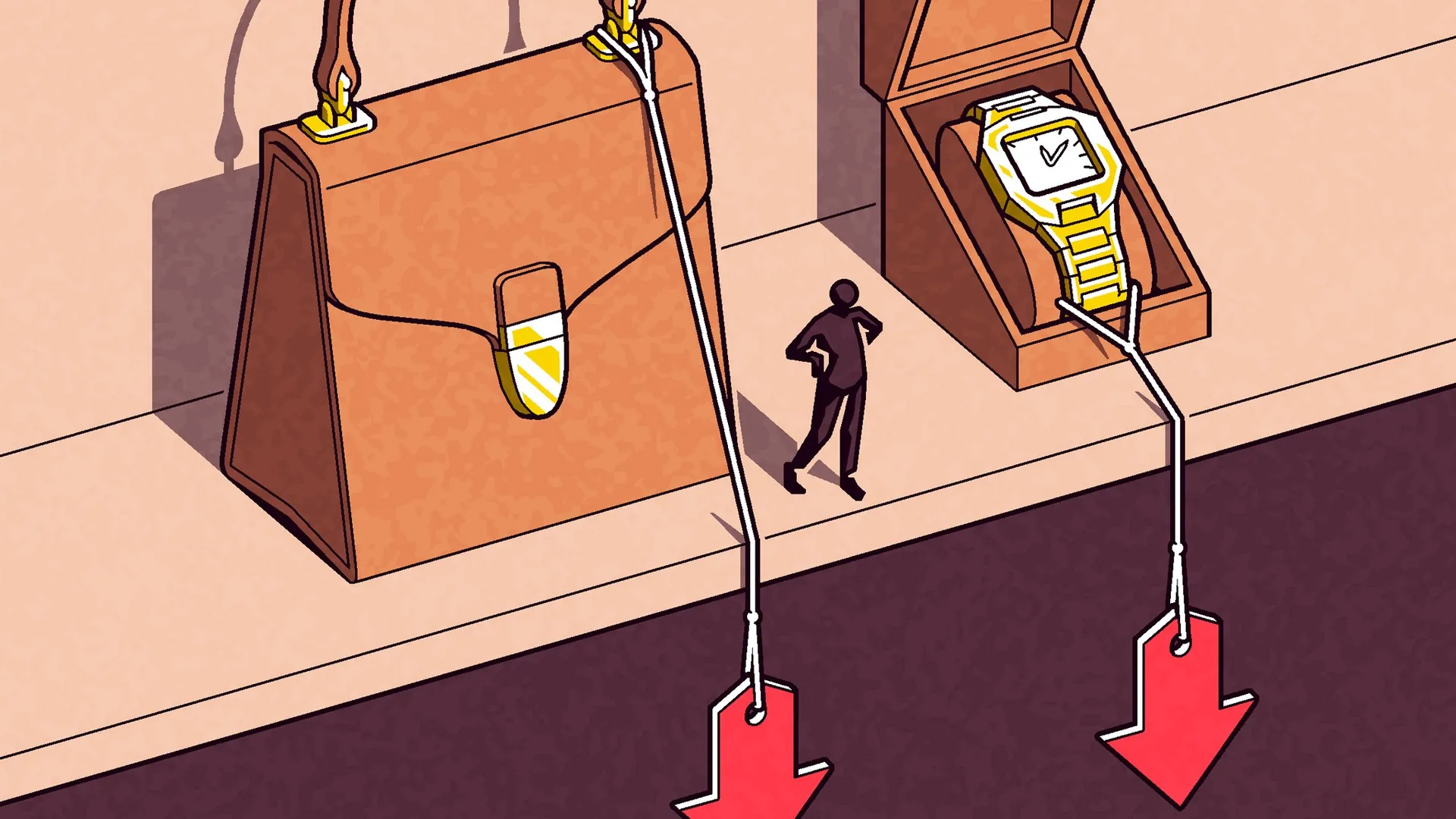

While the super-rich are still spending as if they exist in a separate gravitational orbit, the aspirational consumers who make up the all-important “mass luxury” part of the market are scaling back. That goes a long way to explaining why many of the world’s largest luxury companies have underperformed recently. There are, after all, only so many watches and handbags that the one per cent can buy.

尽管超级富豪们仍在挥霍无度,仿佛生活在一个独立的引力轨道上,但构成市场重要部分的“大众奢侈品”有抱负消费者却在缩减开支。这在很大程度上解释了为什么许多全球最大的奢侈品公司最近表现不佳。毕竟,百分之一的人群能购买的手表和手袋数量是有限的。

And the number of people who can afford this sort of thing is declining. The latest Bain luxury market report, released in November, found that the luxury market shrank by about 50mn consumers over the past two years, in part because younger consumers are turning away from traditional luxury goods. I suspect that this is one of the reasons you are (finally) seeing older people, particular older women, in advertising and even on fashion runaways. They are the only people buying stuff.

能够负担得起这种商品的人数正在减少。贝恩最新的奢侈品市场报告于11月发布,发现奢侈品市场在过去两年中减少了大约5000万消费者,部分原因是年轻消费者正在远离传统奢侈品。我怀疑这就是为什么你(终于)在广告中甚至时装秀上看到老年人,特别是老年女性的原因之一。因为她们是唯一还在购买这些商品的人。

But there are other reasons that luxury has lost its lustre, notable among them the pervasive feeling that economic insecurity may be around the corner, despite buoyant markets.

但奢侈品失去光彩还有其他原因,其中显著的是尽管市场繁荣,人们普遍感到经济不安全可能即将来临。

If you discount the V-shaped Covid blip, we are six years overdue for a recession. Meanwhile, the bizarre world of the US equity markets, which are priced for perfection, has everyone at New York dinner parties talking about when (and if) they are planning to take at least some of their portfolios to cash.

如果不考虑V型的新冠疫情波动,我们已经六年没有经历经济衰退了。同时,美国股市的奇异现象——其定价堪称完美——让纽约晚宴上的每个人都在讨论他们何时(以及是否)计划将至少部分投资组合转换为现金。

Despite this, or perhaps because of it, the super-rich can still spend. Those in the ultra-wealthy segment of the luxury market — meaning the people who spend their excess cash on yachts and jets (both sectors which are doing quite well) — have seen their net worth bolstered by double-digit asset market growth. There’s big fleet expansion in the super high-end cruise business, and growth in luxury cars and hotels is still strong.

尽管如此,或者正因为如此,超级富豪仍然有能力消费。奢侈品市场中的超富裕群体——即那些将多余现金花在游艇和私人飞机上的人(这两个行业表现良好)——他们的净资产因资产市场的两位数增长而提升。超级高端邮轮业务正在大规模扩张,豪华汽车和酒店的增长依然强劲。

But less wealthy people who were once ready to splurge on that $500 handbag are being far more cautious. That’s because they, unlike the super-rich, still have to worry about working. Aspirational consumers’ disposable incomes are down, having been affected by reduced job openings and increasing voluntary turnover rates, according to the Bain study. That’s why overall luxury sales are expected to drop by about 2 per cent in 2024, and remain flat next year.

但那些曾经准备在500美元手袋上挥霍的较不富裕的人变得更加谨慎。因为他们不像超级富豪那样无忧无虑,还得担心工作。根据贝恩的研究,渴望消费的有抱负消费者的可支配收入因职位空缺减少和自愿离职率上升而下降。这就是为什么预计2024年整体奢侈品销售将下降约2%,并在明年保持平稳。

So what does all this tell us about what’s to come in the broader economy in 2025? There are three key lessons.

那么,这一切对我们2025年的整体经济有何启示呢?主要有三条经验。

First, a US equity market correction will come, perhaps this year, perhaps next. But few rich people I speak with have any doubt that it’s on its way. The fact that even the affluent are scaling back purchases of fine wines, jewellery, watches, and art means that a lot of asset-wealthy consumers are expecting a slowdown and some kind of market correction, even if we don’t see a full-blown trade war.

首先,美国股市可能会出现回调,也许是今年,也许是明年。但与我交谈的富人中,很少有人怀疑它正在到来。即使是富人也在减少对优质葡萄酒、珠宝、手表和艺术品的购买,这一事实意味着,即使我们没有看到全面的贸易战,许多资产富裕的消费者已经预期经济放缓和某种市场调整。

Second, if the latter did come to pass, the luxury sector, which is dominated by high-value European goods, would fall much faster and harder than other areas. Europe doesn’t have tech giants, but it has luxury conglomerates — two out of the top five largest European firms by market capitalisation are LVMH and Hermès.

其次,如果后者真的发生,奢侈品行业将比其他领域下滑得更快更严重,因为该行业主要由高价值的欧洲商品主导。欧洲没有科技巨头,但有奢侈品集团——按市值计算,欧洲五大公司中有两家是路威酩轩(LVMH)和爱马仕。

One could easily imagine the products these companies make becoming targets for tariffs if Trump turns a critical eye to the continent. Remember when the EU retaliated against Trump’s steel and aluminium tariffs by putting tariffs on motorcycles, adding $2,200 to the price of a Harley-Davidson? European luxury brands — including German automakers and French fashion houses — would be easy political pickings.

我们不难想象,如果特朗普对欧洲大陆持批评态度,这些公司生产的产品会成为关税目标。还记得欧盟通过对摩托车征收关税来报复特朗普的钢铝关税吗?这使得一辆哈雷戴维森(Harley-Davidson)的价格增加了2200美元。包括德国汽车制造商和法国时装品牌在内的欧洲奢侈品牌很容易成为政治上的牺牲品。

Finally, there’s a growing sense in the luxury business that some of the price inflation we’ve seen over the past several years simply can’t last. Already, only the top name brands in any given category of personal luxury can hold their price points, as aspirational clients downshift to cheaper watches or spirits.

最后,奢侈品行业中越来越多的人意识到,我们在过去几年中看到的一些价格上涨根本无法持续。目前,在任何个人奢侈品类别中,只有顶级名牌才能维持自己的价位,因为有抱负的客户会转向价格更低的手表或烈酒。

Ditto travel and leisure. I recently spoke to two private equity investors in the hotel business in the US who predicted that while top-notch markets such as Jackson Hole, Nantucket and Martha’s Vineyard would probably be fine in a downturn, nosebleed rates for rooms at a four-star hotel in Houston on a Tuesday night would come down at the first sign of a market correction.

旅游和休闲行业也是如此。我最近与两位在美国酒店业的私募股权投资者交谈,他们预测,尽管像杰克逊霍尔(Jackson Hole)、楠塔基特和玛莎葡萄园(Martha’s Vineyard)这样的顶级市场在经济下行时可能会安然无恙,但在市场出现调整的第一个迹象时,休斯顿一家四星级酒店周二晚上的高价房费将会下降。

For those of us who’ve noticed that $500 seems to be the new $300 for hotel rooms in major American cities, that’s welcome news. But as we wait for rates to fall, there’s always the small splurge on a high-end beauty item.

对于我们这些注意到在美国主要城市,500美元似乎已经成为新的300美元酒店房间的人来说,这是个好消息。但在我们等待价格下降的同时,总是可以小小奢侈一下,购买一件高端美容产品。

The “lipstick index,” a term coined by beauty titan Leonard Lauder, posits that when purchases of small luxury items like a new cosmetic go up, a recession is imminent. In 2024, beauty was one of the few luxury categories with positive growth, as consumers sought out that small splurge.

“口红指数”是美容巨头伦纳德•兰黛创造的一个术语,它认为当购买新化妆品等小奢侈品的数量增加时,经济衰退迫在眉睫。2024年,随着消费者寻求小额消费,美容是少数几个正增长的奢侈品类别之一。

If my husband is reading this, I’m hoping for a tube of Celine’s Rouge Triomphe in the stocking.

如果我丈夫在读这篇文章,我希望在圣诞袜里能有一支Celine的Rouge Triomphe口红。