Something peculiar is afoot at MicroStrategy.

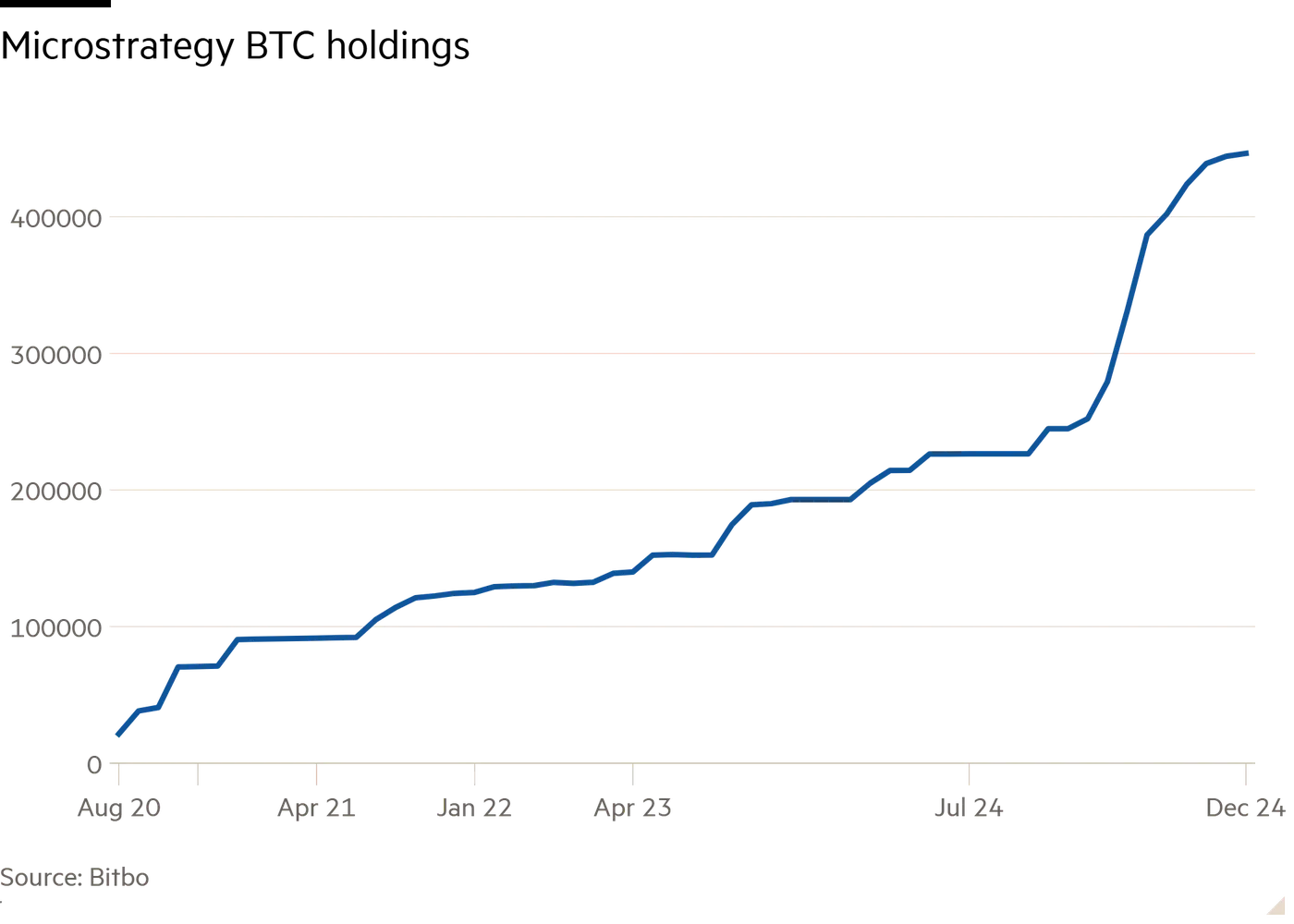

The company has amassed over two per cent of all bitcoin in existence, funded through a combination of shares and convertible bonds. This strategy has turned a humdrum business software firm into something akin to a bitcoin ETF, albeit one trading at a frothy premium to its net asset value. The stock is up over 20 times since the pivot to bitcoin in August 2020.

Yet recent months have revealed some curious contradictions in this narrative. While bitcoin has maintained its stratospheric altitude at around $100,000 per coin, MicroStrategy’s stock has drifted lower, shedding 40 per cent since peaking intraday on November 21 at $550, which implied at the time a market cap of $124bn. Even its inclusion in the Nasdaq 100 index failed to boost the share price. Its premium to net asset value has meanwhile decreased from a high of 3.8 times to 1.9 times. This decline in the share price is happening even as the company continues to acquire more bitcoin.

More telling still is the company’s frenetic execution of its $21bn “at-the-money” equity offering, announced with much fanfare on Hallowe’en. What was billed as a three-year marathon has been run at the pace of a sprinter on amphetamines, with over two-thirds of the allocation exhausted in just two months. This is odd behaviour for a strategy ostensibly designed for disciplined, incremental buying. There has been no buying on the dip. Even as bitcoin’s price has held firm near its peak, Michael Saylor, the company’s chair, has ramped up bitcoin purchases at breakneck speed.

According to JPMorgan analysts, MicroStrategy accounted for an astonishing 28 per cent of capital inflows into the cryptocurrency market in 2024.

There is also no time to waste. Last Friday the company announced plans to raise up to $2bn in perpetual preferred stock this quarter to buy more bitcoin, although the precise timing and terms have not yet been announced. This comes just over a week after MicroStrategy said it was seeking shareholder approval to increase its share count by over 3000 per cent from 330mn to 10.33bn.

The timing smacks of opportunism, as if the company’s leadership recognises that the current NAV premium — the financial equivalent of finding money growing on trees — might not be permanent. There’s a hint of urgency (or desperation) in the air, an extreme haste to lock in this discrepancy between MicroStrategy’s stock and the bitcoin price before it is arbitraged away.

Compounding the intrigue is the behaviour of MicroStrategy’s senior leadership. Saylor has publicly condemned diversification, urging investors to concentrate their portfolios in bitcoin with almost religious conviction. He has even suggested that people mortgage their homes to buy bitcoin!

His lieutenants, however, appeared to have missed the sermon, cashing in huge chunks of their stock holdings for the very fiat currency their boss routinely derides. November saw a flurry of insider selling, as executives converted their shares into good old-fashioned Yankee dollars. MicroStrategy shares may be a bitcoin proxy and so ostensibly a unique store of value, but with insider sales totalling $570mn in 2024, management is not HODLing the stock.

The paradoxes don’t stop there. In following its strategy MicroStrategy appears structurally predisposed to buying bitcoin at ever-higher prices. During the crypto winter of 2022-2023, when bitcoin wallowed in the teens and twenties, the company’s purchases slowed to a crawl as its stock traded around NAV. Yet as bitcoin’s price soared, so too did MicroStrategy’s buying frenzy. The business model seems less a bet on bitcoin’s inherent value and more a wager on the fervour it inspires.

The premium to NAV holds as long as bitcoin keeps ascending, and that premium is the glue that holds the entire strategy together. By selling stock at 2-3 times NAV, MicroStrategy is in effect buying bitcoin at a substantial discount. Without the NAV premium, the stock price falls, and much of the $7.2bn of convertible bonds outstanding risks being redeemed for cash at maturity, not converted into new shares. At that point, things get a lot stickier for MicroStrategy because its software business loses money and it generates no cash from bitcoin. (MicroStrategy trumpets a metric called “BTC yield”, which implies a return but really measures the percentage increase in bitcoin per share from its issue of stock and purchases of bitcoin. There is in fact no “yield” in the conventional sense of dividends or income streams.)

Perpetual appreciation is a demanding ask for any asset class, and the company seems to know it. Saylor’s relentless proselytising for bitcoin — an odd choice for someone accumulating the asset — suggests an acute awareness of the stakes. It’s also no surprise that he is cultivating government support, meeting with President-elect Donald Trump’s son Eric (which preceded a sharp 13 per cent rise in the stock on Friday) and advocating for a Strategic Bitcoin Reserve. It’s an ironic twist for a cryptocurrency long touted as a bulwark against government meddling. But when your playbook hinges on unrelenting enthusiasm, pragmatism trumps principle.

The question that lingers is whether MicroStrategy can maintain its premium valuation through sheer force of narrative much like the meme stocks that have defied conventional valuation metrics. The company has effectively become a publicly traded bet on bitcoin’s future, but one that still trades at a substantial mark-up to the underlying asset. This premium represents either the market’s faith in Saylor’s vision or a temporary, psychology-driven inefficiency waiting to be arbitraged away.

The whole affair feels like a high-stakes game of musical chairs, and as the tempo quickens, even the insiders seem to be hedging their bets. Whether MicroStrategy’s gambit will be remembered as a stroke of financial genius or a cautionary tale remains unresolved. For now, the music plays on, with the volume dialled up to 11, and the faithful — or the merely hopeful — keep dancing.

Further reading:

— MicroStrategy’s secret sauce is volatility, not bitcoin (FTAV)

— Examining MicroStrategy’s record-shattering $21bn ATM (FTAV)