Hundreds of defence and aerospace executives will this week descend on an airfield in southern England along with ministers, generals, air marshals and hangers-on, to attend the industry’s version of the Glastonbury music festival.

This year, they will meet with a renewed sense of purpose. Until it was interrupted by the Covid-19 pandemic, the Farnborough International Airshow has been a regular event for more than seven decades. But for the first time in many years, the industry is relishing the prospect of a flood of money coming its way.

The war in Ukraine has prompted European governments to reverse the course of years of shrinking defence spending. Now, they want to do more to confront a newly aggressive Russia — and the companies at Farnborough hope to benefit.

The war has galvanised efforts to make good on vague or failed ideas to bolster Europe’s status as a cohesive global military power. There are proposals for greater collaboration on military programmes and the streamlining of weapons manufacturing. Even Germany, long regarded as the big political stumbling block to greater investment, has abandoned decades of aversion to military engagement. It will boost spending and support more joint European projects.

Still, it remains unclear whether the rush of new policy announcements will become a reality. Kajsa Ollongren, the Dutch minister of defence, admits similar pledges have been made before, only to fail. This time, however, she believes the reality of combat in Europe will help to force the issue. “In the past . . . people have been saying this in the context of [defence] budget cuts. And now we are saying it in the context of budget increases,” she says. “That’s a big engine for us to use.”

Europe’s plans may yet be hampered by some harsh realities. A portion of the recently announced budget increases will have to be spent on boosting the salaries of armed forces and replenishing stockpiles of weapons that have been depleted in the effort to help Ukraine, before new hardware can be considered.

Then there is the ever-present siren call of US equipment. Germany’s first big purchase after announcing it would launch a €100bn military modernisation fund was the American-made F-35 fighter jet, capable of carrying nuclear weapons. Some European industry executives worry that a large part of the extra money will not be spent at home.

“I see an inherent risk that we focus too much on satisfying short-term demands by predominantly buying non-European off-the-shelf equipment,” says Michael Schoellhorn, chief executive of Airbus Defence and Space.

To do so, he warns, would be to undermine Europe’s “long-term technological excellence”, which could create “additional dependencies” in the future and potentially “result in a weakening of its defence [industry] and thereby be detrimental for European integration as a whole”.

“We need to spend better and to spend more,” says Alessandro Profumo, president of ASD, the European industry’s trade association, and chief executive of Italy’s defence champion, Leonardo. To achieve that, he adds, there needs to be closer co-ordination at EU level on procurement: “We must have this integration process. It won’t be fast, but it has to happen.”

Replenish, replace, rebuild

Inside a boxy grey building on an industrial estate in east Belfast in Northern Ireland, engineers are busy working on a weapon that has become one of the symbols of Ukraine’s pugnacious resistance to the Russian advance: a shoulder-mounted rocket launcher called the Next Generation Light Anti-tank Weapon, or NLAW.

Designed by Sweden’s defence champion, Saab, and assembled by the UK subsidiary of French group Thales, the NLAW has been shipped in its thousands to the Ukrainian frontline. Its success is one of the most visible examples of how the war could boost the European defence industry, but so far all the NLAWs sent to Ukraine by the UK have come from government stockpiles, rather than new orders.

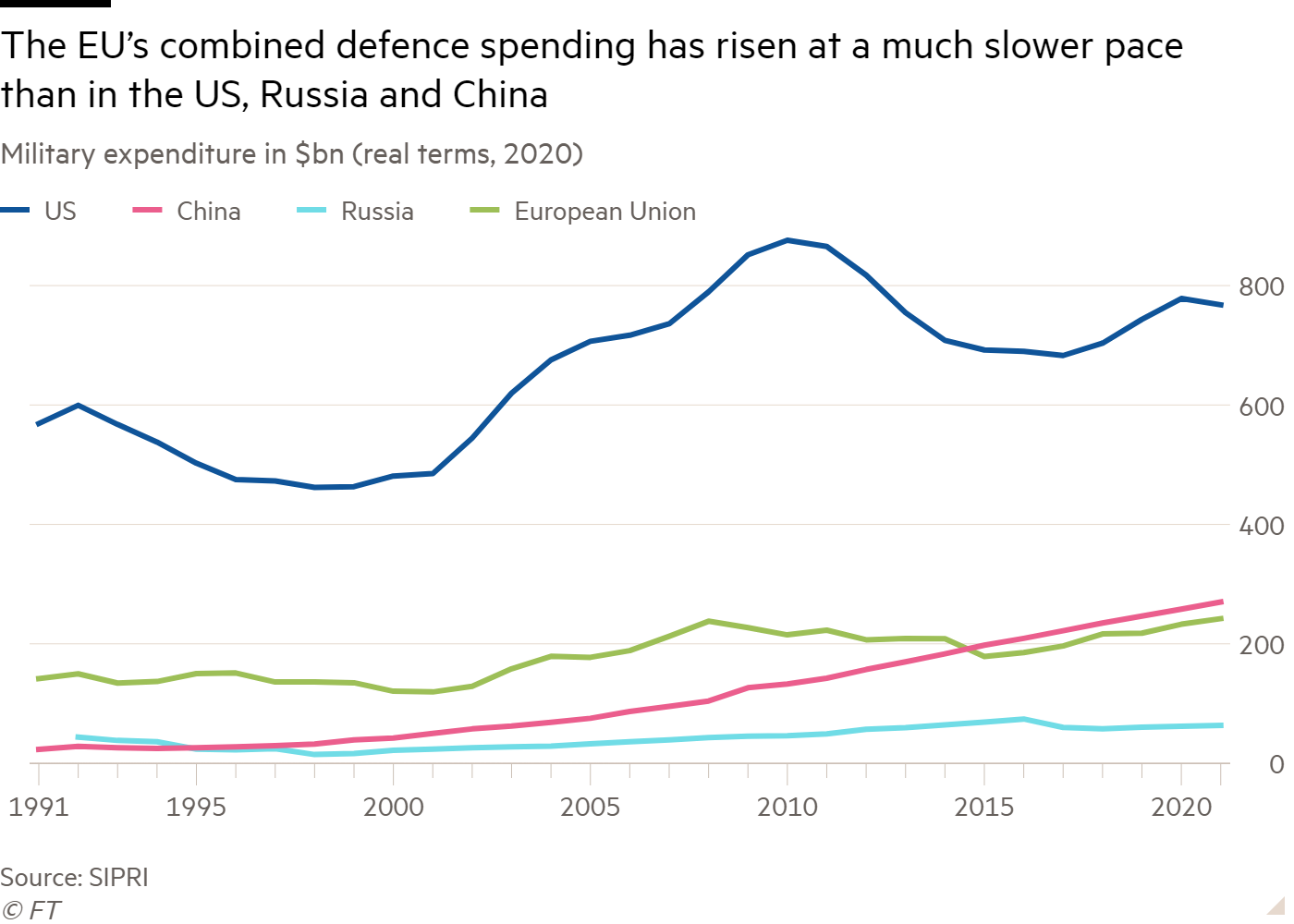

Since Russia’s full-blown invasion of Ukraine began in February, EU member states have announced defence spending increases worth about €200bn. But officials point out that the rise follows years of cuts and underspending. Between 1999 and 2021, the bloc’s combined spending on defence rose just 20 per cent, compared with 66 per cent by the US, 292 per cent by Russia and 592 per cent by China.

The war has also exposed Europe’s general lack of preparedness as countries scrambled to find hundreds of tanks, multiple rocket launch systems and artillery from national stockpiles to help deter the Russian advance. Those stockpiles are now running low.

The bloc’s industrial challenge, according to Bastian Giegerich, director of defence and military analysis at the International Institute for Strategic Studies, is threefold: to replenish stockpiles run down over the past two decades; replace obsolete Cold War-era equipment that is being flushed out by the war in Ukraine; and rebuild and innovate for new capabilities.

“The industrial challenge will be to do the replenish, the replace and the rebuild all at the same time,” he says. “I think that makes it quite challenging.”

There is an added political challenge: defence has in the past been regarded as the sovereign preserve of individual member states, not to be lightly surrendered to Brussels. The EU has been trying to develop its capacity for independent military action and strategic autonomy since the launch of its common security and defence policy in the late 1990s. But progress has been slow.

The bloc’s defence industry is still a mix of large international prime contractors and nationally-focused companies, as well as hundreds of small and medium-sized businesses. There is greater fragmentation in the land and naval defence sectors compared with aerospace, where there have been more attempts at multinational co-operation, driven in part by high R&D and acquisition costs.

But even in aerospace the record is patchy, says Douglas Barrie, senior fellow for military aerospace at IISS, and “the successes have often courted failure”. He notes, for example, that even the successful Tornado and Eurofighter pan-European fighter programmes at “various points threatened to unravel”.

European nations are currently pursuing two separate next-generation combat aircraft projects which target similar requirements: Tempest, led by the UK with Sweden and Italy, and the Future Combat Air System, involving France, Germany and Spain.

The poor record on co-operation is borne out by spending. In 2020, just 11 per cent of EU defence budgets were spent on collaborative projects — well below the 35 per cent target set by Brussels’ own European Defence Agency. The picture is the same in research and technology spending: in 2020 just 6 per cent was spent in collaboration with other member states, the lowest level since data collection began in 2005 — and well short of their 20 per cent target.

Between them, the bloc’s militaries operated 17 different main battle tanks compared to just one for the US, according to 2017 data published by the European Commission. The EU data, however, included variants and Cold War-era models, as well as the UK’s Challenger system. There were 29 different naval frigates or destroyers, compared with just four different types in the US.

“Of course we are going to do more procurement. But we want to do it jointly and think we should really focus on co-operation, co-ordination, standardisation,” says Ollongren.

‘The orders will come’

In March, the European Council endorsed the EU Strategic Compass on defence, which proposes creating a rapid deployment force in Europe as well as increasing funding. The same month, in Versailles, European leaders called for the commission to propose measures to strengthen Europe’s defence industrial base.

Under those plans, the EDA, which was set up in 2004 but has had a limited impact on national strategy so far, has been tasked with a series of new initiatives. These include more money for the European Defence Fund and the creation of a “procurement task force” to focus on short-term needs.

In the medium-term, priorities include the modernisation of Europe’s air defences and expanding drone, cyber and space capabilities. Another target is the development of a new battle tank, the MGCS tanks project, to replace Germany’s Leopard and France’s Leclerc. Waiving value added tax on defence equipment produced in Europe has also been suggested.

There is now a “huge opportunity to use this big increase in defence spending to overhaul the EU’s defence capabilities — and for the first time do it in a joined up way, where countries stop this silly inefficient thing of ignoring the benefits of joined-up purchases”, says one senior EU official.

Industry executives have welcomed the plans as evidence of a strategic shift. “The impact on . . . defence infrastructure is already more profound and global than many people realise,” says Charles Woodburn, CEO of BAE Systems. Jan Pie, the secretary-general of ASD, shares that hope: “The institutions have acted quickly and now it is up to the member states whether these ideas will fly or not.”

Leonardo’s Profumo cites the multibillion-euro project to deliver the bloc’s first unmanned drones in 2029 as an example of the kind of pan-European programme that will accelerate co-operation. “Eurodrone is taking off. I am sure that others will be there. Thanks to these [projects], the integration process will move forward,” he says.

But Micael Johansson, chief executive of Saab, which produces Gripen fighter jets as well as multiple weapons systems and submarines, warned that the “tools or forums” to deliver on the commission’s plans still need to be set up. “It is a complicated process,” he adds, and it will take time before such initiatives lead to actual contracts for industry.

In the past, divisions over IP ownership and workshare between companies have bedevilled large pan-European programmes. “How intellectual property rights are distributed is the biggest challenge,” says Armin Papperger, chief executive of Germany’s Rheinmetall.

The case of the Franco-German-Spanish Future Combat Air System is a study in how difficult it is to bridge industrial divisions. Battles between Airbus and Dassault over technology sharing and who should lead critical parts of the programme have beset the project since its launch.

Yet ASD’s Pie insists that programme should not be seen as a cautionary tale about how EU co-operation cannot work. “This is an example of the most highly technological and political and expensive project being developed,” he says. “When we think of overall procurement in Europe, we need to realise there are multiple examples of high-volume products that could be jointly procured rather than . . . at a national level.”

Wartime financing

One significant hurdle for the defence industry in recent years has been access to finance, as banks and fund managers have bought into the trend for socially responsible investing. Executives had begun to worry that the sector was in danger of becoming viewed as uninvestable by funds keen to burnish their environmental, social and governance credentials.

But the war has changed the mood music for some investors — if not all. Sweden’s SEB bank, which before the conflict had put in place a blanket ban on investing in any company deriving more than 5 per cent of its revenue from the “development, production and service of weapons comprising combat equipment, or certain other military equipment”, performed a U-turn in the spring. Six of its funds are now allowed to invest in the defence sector.

Debates about a rethink of exclusion criteria for defence companies are also taking place at some of Germany’s state and private banks. LBBW, one of the country’s public sector banks, told the Financial Times that in view of “current developments” it had adjusted its guidelines on arms and weapons transactions.

The bank may now participate in the “financing and securing of exports of war weapons and armaments”, LBBW said, if Germany’s export control office has approved delivery to the “supplied state and the state is not on the list of excluded arms and war weapons export countries”.

BAE’s Woodburn reckons that “from an investor perspective, Europe has moved pretty quickly”. He warns, though, that “one of the more challenging markets is still the UK, where fund mandates haven’t changed”.

A final challenge, according to Airbus’s Schoellhorn, who is also president of Germany’s aerospace industries association, BDLI, is that of defence exports. “It’s important that Germany seeks a European solution together with its partners, instead of pursuing a purely national approach,” he says.

This is as important for running programmes like Eurofighter Typhoon (a multinational fighter jet) as for future large European projects, he adds. A lack of consensus in Europe on arms exports has, in the past, complicated countries’ key trading relationships.

Officials say co-operation between Nato and the EU, two Brussels-based multinational organisations that are headquartered just 5km apart but were far from working in lockstep before the onset of war in Ukraine, is critical for any of the planned initiatives to work.

Nato officials, who represent almost all the continent’s militaries, say that even ramped-up European defence spending will not achieve its goals if the EU does not force its member states to streamline procurement and swap inefficient national goals for pan-European ones.

“We can demand higher and higher defence spending all we like,” says one senior Nato official, “but if that lot [the EU leadership] can’t coerce them into spending it properly, it’s not going to make a massive difference.”

Meanwhile, Europe should be careful to make sure that a greater focus on its own capabilities does not signal to the US that its companies are no longer welcome on this side of the Atlantic, says Saab’s Johansson. “The transatlantic link is extremely important,” he says. To suggest otherwise or to signal that Europe’s borders are closed to outsiders “would not be good for the competitiveness of the industry going forward,” he adds.

Finland and Sweden’s recent move to join Nato has boosted hopes of more collaboration. If the two Nordic countries become full members, just four EU states — Austria, Cyprus, Ireland and Malta — will remain outside the US-led military alliance.

Josep Borrell, the EU’s foreign, defence and security chief, is clear about the importance of this moment of renewed unity: “It is crucial that member states invest better together to prevent further fragmentation and address existing shortfalls,” he says. “If we want modern and interoperable European armed forces, we need to act now.”