The humanoid robot Tesla is expected to unveil this month is an expert bit of stagecraft. Optimus, billed as the future of labour, is sci-fi come to life. But futuristic robots are not what investors in the electric carmaker care about. Production in China, progress at the new factory in Germany, material supply and rival vehicle sales all take precedence.

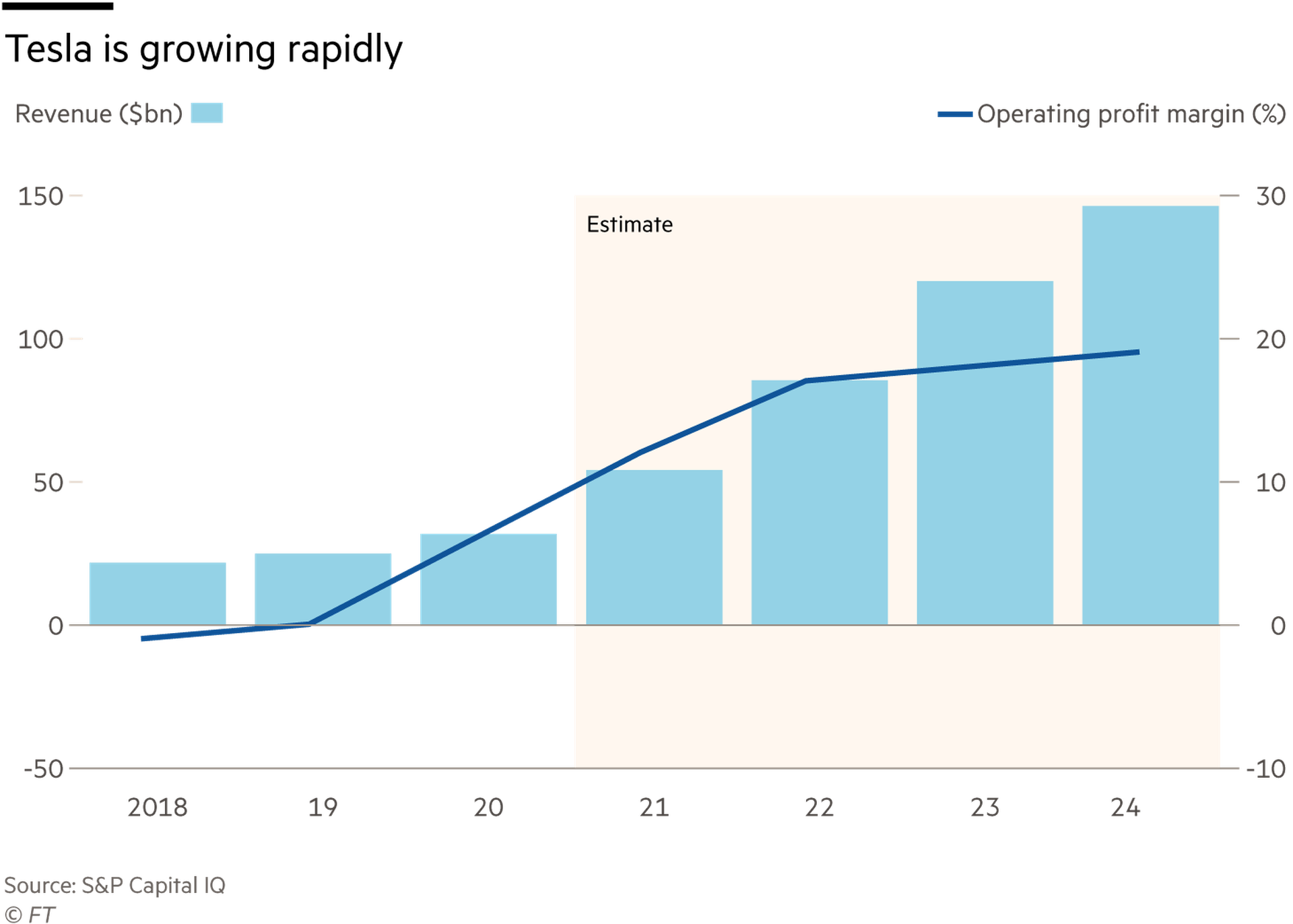

Tesla makes the most popular electric vehicle in the world. As more traditional carmakers enter the EV market this achievement becomes more impressive. Global demand for electric cars has kept pace with supply — thanks in no small part to Tesla’s ability to make them desirable. In the last quarter, its sales rose 42 per cent.

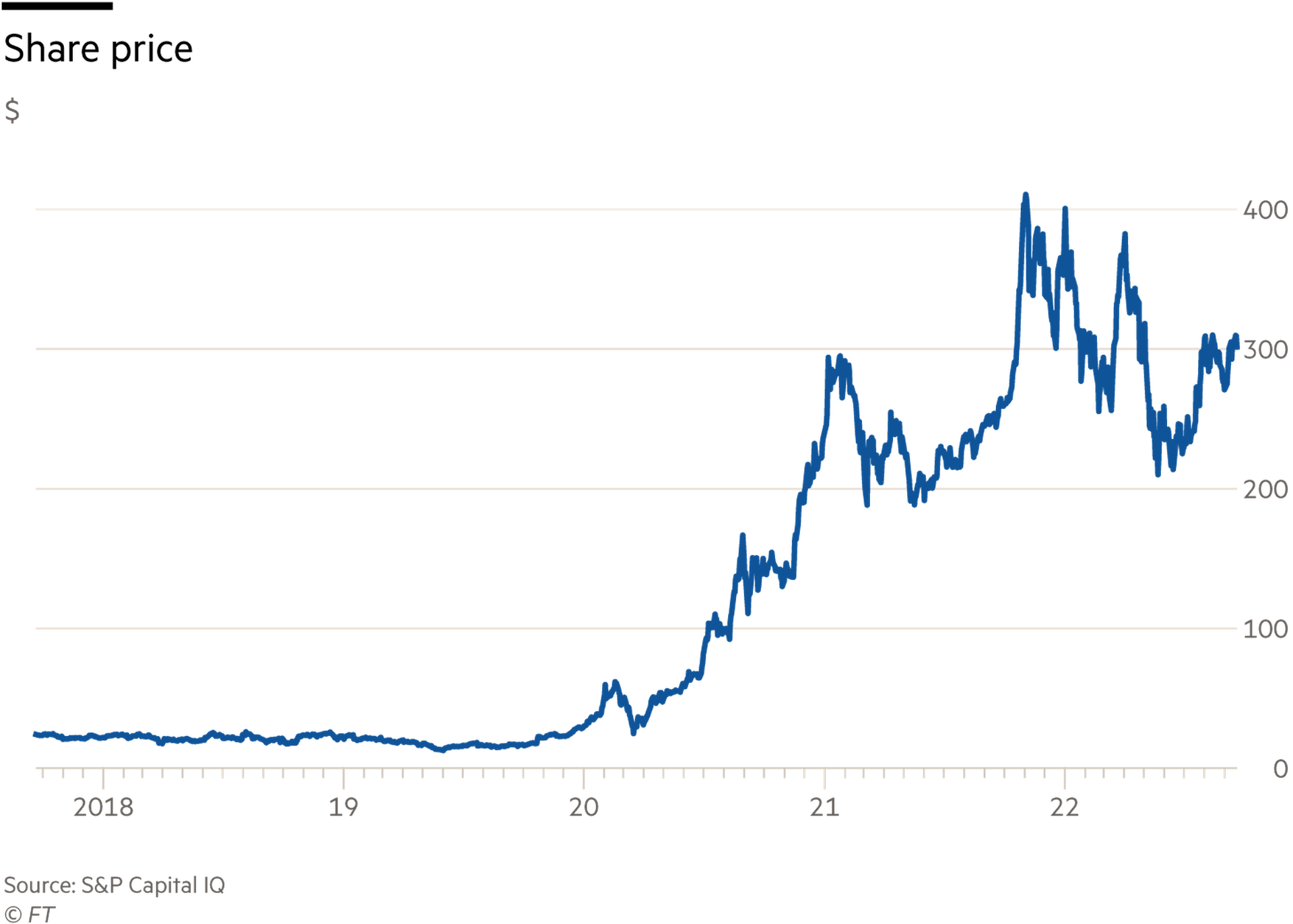

Over five years, the stock is up 1,200 per cent. That breeds investor loyalty. It might have lost about a quarter of its value in the year to date but it has avoided the 70 to 80 per cent price collapse that some tech stocks have suffered in the market rout.

Yet is hard to see what could lift the price back to last year’s high. A stock split in August, the company’s second in two years, did not help. Stock splits can be used to attract more retail investors by offering a lower entry price per share. But Tesla already has a strong base of retail investors who hold about 37 per cent of the stock, according to S&P Global data.

Investors are right to be wary about the 60 times price-to-earnings ratio too — even if it has more than halved since November last year. It is more than ten times the size of larger, more established carmakers like Volkswagen. Even BYD, China’s electric car giant, trades at a far lower multiple. Musk fandom still accounts for a significant proportion of Tesla’s valuation.

News about Optimus is expected to be released in Tesla’s upcoming artificial intelligence day. But Tesla’s ability to scale production and maintain profit will underpin the share price. The wild card is not robots but Twitter. Musk is still the largest investor in Tesla, though he has sold more than $15bn of shares to raise cash this year. If forced to go through with his deal to buy Twitter for $44bn he may be forced to sell more.