尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

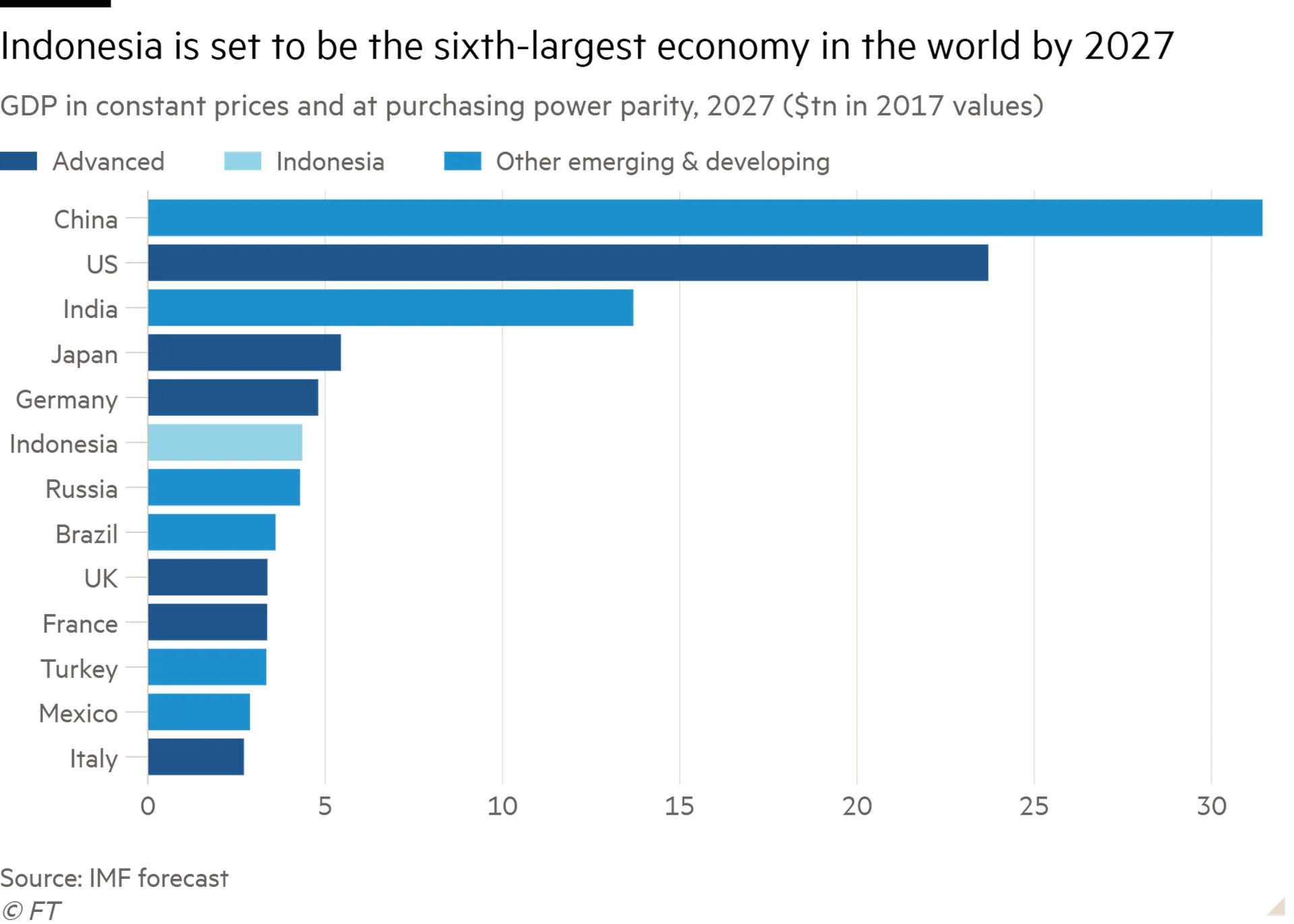

With the world’s fourth largest population, a flourishing middle class, a digitalising economy and five of the seven critical minerals for making electric batteries, Indonesia has long been considered a sleeping giant of great potential.

印尼拥有世界第四大人口、蓬勃发展的中产阶级、数字化的经济和制造电池所需的七种关键矿产中的五种,长期以来一直被认为是一个潜力巨大的沉睡巨人。

At a conference held by UOB Asset Management in March, Colin Ng, head of Asia equities for the financial services group, called Indonesia, a “sitting jackpot”. “When you invest in Indonesia, you are basically investing in the future,” he said.

在大华银行资产管理公司(UOB Asset Management)今年3月举行的一次会议上,这家金融服务集团的亚洲股票主管Colin Ng称印尼是一个“可坐等的头奖。当你在印尼投资时,你基本上是在投资未来,”他说。

For Indonesia’s economy — the largest in south-east Asia — the global shift to producing electric vehicles has provided a strong tailwind. The country has abundant reserves of nickel — a key mineral for creating batteries — and is aiming to become a hub for the new energy supply chain.

对于东南亚最大的经济体印尼来说,全球转向生产电动汽车提供了强劲的推动力。该国拥有丰富的镍储量——一种制造电池的关键矿物——并正致力于成为新能源供应链的中心。

Investor interest has followed that of the major carmakers. The number of investors in Indonesia’s capital markets has grown from 1.1mn at the end of 2017 to almost 12mn at the end of October 2023, according to Trimegah Asset Management, a major asset management business in Indonesia — a 10-fold increase in just six years.

投资者的兴趣紧随主要汽车制造商之后。根据印尼主要资产管理公司Trimegah Asset Management的数据,印尼资本市场的投资者数量已从2017年底的110万增长到2023年10月底的近1200万,在短短六年内增长了10倍。

“The majority of growth [was] driven by the availability of digital financial platforms that made it easy for people, especially the younger generation, to invest,” explains Antony Dirga, chief executive at Trimegah.

Trimegah首席执行官安东尼•迪尔加(Antony Dirga)解释说:“大部分增长是由数字金融平台的便捷性推动的,这些平台使人们(尤其是年轻一代)更容易进行投资。”

When you invest in Indonesia, you are basically investing in the future

当你在印尼投资时,你基本上是在投资未来

Among these investors are wealthy individuals from around the world, who have opened banking facilities in the country. According to government data, as of the quarter ended September 2023, total deposits in Indonesia had reached 8,203tn rupiah ($529bn) — a 35 per cent increase from the end of 2019. And the number of accounts increased by 77 per cent, from 301mn accounts to 535mn.

这些投资者中有来自世界各地的富豪,他们在印尼开设了金融账户。根据政府数据,截至2023年9月底的一个季度,印尼的存款总额达到82.03亿印尼盾(约合5290亿美元),比2019年底增长了35%。账户数量增加了 77%,从 3.01 亿个账户增加到 5.35 亿个。

Vera Margaret, executive director and head of deposit and wealth management at UOB Indonesia says the number of customer information files — electronic records of bank customers — has grown fourfold in the past three years, after it launched digital banking in the country.

印尼大华银行(UOB Indonesia)执行董事兼存款和财富管理主管维拉•玛格丽特(Vera Margaret)表示,自大华银行在印尼推出数字银行业务以来,客户信息档案(银行客户的电子记录)的数量在过去3年里增长了4倍。

But she believes Indonesia must do more if it wants to lure more wealthy individual clients away from global family offices or big private banks in Hong Kong or Singapore. That will mean offering a greater variety of financial products, as well as making such services more accessible to middle-income clients, Margaret says.

但她认为,如果印尼想从全球家族理财室或香港或新加坡的大型私人银行吸引更多富有的个人客户,就必须做得更多。玛格丽特说,这将意味着提供更多样化的金融产品,并使中等收入客户更容易获得此类服务。

So far, fund inflows have been disappointing. Although wealth managers and supply chain executives agree on the potential of Indonesia, the country of 277mn people has struggled to translate that interest into broader, international investment.

迄今为止,基金流入情况令人失望。尽管财富管理公司和供应链高管都认同印尼的潜力,但这个拥有2.77亿人口的国家一直难以将这种兴趣转化为更广泛的国际投资。

The local fund management industry had 508.19tn rupiah ($32.5bn) of assets under management (AUM) at the end of 2022, a 12.4 per cent decline from 579.93tn rupiah ($37.1bn) in 2021, according to figures from the Financial Services Authority of Indonesia. In addition, AUM stood at about 4 per cent of GDP, compared with 25 to 30 per cent in Malaysia and Thailand.

根据印尼金融服务管理局(Financial Services Authority of Indonesia)的数据,截至2022年底,当地基金管理业管理的资产(AUM)为508.19万亿印尼盾(合325亿美元),较2021年的579.93万亿印尼盾(合371亿美元)下降12.4%。此外,该国的资产管理规模约为GDP的4%,而马来西亚和泰国的这一比例为25%至30%。

“The tax and administrative situation here is not at all conducive to the establishment of domestic family offices and wealth management infrastructure,” argues Eugene Galbraith, director at mobile phone tower company PT Protelindo, and a longtime observer of Indonesian business. However, the more mass affluent, that is to say high end-focused wealth management businesses have seen “some growth”, he adds.

“这里的税收和行政状况根本不利于建立国内家族办公室和财富管理基础设施,”手机信号塔公司PT Protelindo董事尤金•加尔布雷斯(Eugene Galbraith)表示。加尔布雷斯长期观察印尼商业。不过,他补充称,更富的大众财富管理业务(即专注于高端的财富管理业务)出现了“一些增长”。

Some of the problems holding back Indonesia’s manufacturing sector help to explain the difficulties wealth managers find

阻碍印尼制造业发展的一些问题,有助于解释财富管理机构所遇到的困难

“Indonesia has been fantastic at attracting investment in tech start-ups, for example, thanks to its large domestic market,” says Steven Westervelt, Singapore head of global investigations firm Nardello & Co. “There are many businesses filling and creating the needs of Indonesian people. But, in terms of making products and selling them to the global market from the US to Europe, they have not been as successful.”

全球调查公司Nardello & Co.的新加坡主管史蒂文•韦斯特维尔特(Steven Westervelt)表示:“例如,由于其庞大的国内市场,印尼在吸引科技初创企业投资方面一直表现出色。有许多企业满足并创造了印尼人民的需求。”但是,在制造产品并将其销售到从美国到欧洲的全球市场方面,他们就不那么成功了。”

High costs, unclear tax regulations and opaque bureaucracy have dogged Indonesia’s attempts to persuade more multinationals to build domestic factories and provide a broad boost to its economy, beyond its mining sector, experts say.

专家们表示,高昂的成本、不明确的税收法规和不透明的官僚作风,一直困扰着印尼政府说服更多跨国公司在国内建厂,并在采矿业之外为该国经济提供广泛提振的努力。

High tech companies such as Apple, Sony and Samsung have picked neighbouring countries over Indonesia to expand in, and to manufacture their goods, as they diversify away from China.

苹果(Apple)、索尼(Sony)和三星(Samsung)等高科技公司在将供应链部分搬离中国的过程中,选择了印尼的邻国而不是印尼来扩张和生产它们的产品。

22%Corporate tax rate in Indonesia

22%

Indonesia has not been able to compete effectively. At 22 per cent, its corporate tax rate is not much higher than Vietnam’s 20 per cent, notes Thomas Hansmann, head of operations practice for south-east Asia, at consultants McKinsey & Company. “But Vietnam offers tax breaks and incentives like tax free periods,” points out Hansmann. As a result, a company like Samsung, in effect, pays about 5 per cent in tax in Vietnam.

22%印度尼西亚的企业税率

Even Indonesia’s individual taxes can be difficult to navigate — a factor that many high net worth individuals and wealthy investors take into account, says Galbraith.

印尼一直无法有效竞争。咨询公司麦肯锡(McKinsey & Company)东南亚业务实践主管托马斯•汉斯曼(Thomas Hansmann)指出,印尼22%的企业税率并不比越南的20%高多少。“但越南提供税收减免和免税期等激励措施,”汉斯曼指出。因此,像三星这样的公司实际上在越南只缴纳约5%的税。

Logistics and skilled labour are the other economic hurdles. Despite huge investment by the Joko Widodo government in upgrading ports, toll roads, airports and other infrastructure, logistics costs remain high.

加尔布雷斯说,就连印尼的个人税收也很难把握,这是许多高净值个人和富有投资者考虑的一个因素。

“Logistics costs in Indonesia as a percentage of GDP are 26 per cent,” calculates Vivek Luthra, a managing director specialising in supply chain and operations at Accenture. “Most other south-east Asian countries are around 15 per cent.”

物流和熟练劳动力是其他经济障碍。尽管佐科•维多多政府投入巨资升级港口、收费公路、机场和其他基础设施,但物流成本仍然很高。

埃森哲(Accenture)专门负责供应链和运营的董事总经理维韦克•卢瑟拉(Vivek Luthra)估计:“印尼的物流成本占GDP的比例为26%。其他大多数东南亚国家的比例在15%左右。”

Qualified staff can be hard to find, too. Much of Indonesia’s large labour force lacks the skills that international corporations need. There is an “education gap” compared with countries such as Vietnam and Malaysia, says Westervelt, which is why so many high-tech companies have gone elsewhere.

Such entrenched problems have held back the development of the financial services sector in Indonesia’s economy — such as capital markets and wealth management — experts conclude.

合格的员工也很难找到。印尼庞大的劳动力队伍中,很多人缺乏跨国公司所需的技能。维斯特维尔特说,与越南和马来西亚等国相比,印尼存在着“教育差距”,这也是为什么如此多的高科技公司选择到其他国家发展的原因。

But improvements in per capita income offer some hope. The World Bank estimated that Indonesia’s gross national income (GNI) per capita was $4,580 in 2022 — higher than India but lower than Malaysia or Thailand. Cleaning up Indonesia’s economy and becoming more attractive to foreign groups could help lift the country out of this so termed middle-income trap in which it has been stuck for years.

专家们总结说,这些根深蒂固的问题阻碍了印尼经济中金融服务部门(如资本市场和财富管理)的发展。

“When the country’s GDP per capita exceeds $5,000, people tend to have excess savings available for investments after paying for basic necessities such as food, clothings, mortgages and auto loans,” explains Dirga.

但人均收入的提高带来了一些希望。世界银行估计,到2022年,印度尼西亚的人均国民总收入(GNI)为4580美元,高于印度,但低于马来西亚或泰国。整顿印尼经济,提高对外国集团的吸引力,可能有助于该国摆脱多年来一直陷入的所谓中等收入陷阱。

This year, Indonesia’s GDP per capita is predicted to finally reach $5,000 — which Dirga thinks could give the wealth management industry the potential to reach $150bn to $200bn AUM within the five to seven years.

“当一个国家的人均GDP超过5000美元时,人们在支付了食品、衣服、抵押贷款和汽车贷款等基本必需品后,往往有多余的储蓄可用于投资,”迪尔加解释说。

“[This is] still small in a global context, but Indonesia will probably be among the few countries whose wealth management sector will achieve high double-digit growth in the coming years,” he predicts.

今年,印尼的人均GDP预计将最终达到5000美元——迪尔加认为,这可能使财富管理行业在未来5至7年内达到1500亿至2000亿美元的资产管理规模。

他预测:“在全球范围内,(这一比例)仍然很小,但未来几年,印尼很可能成为财富管理行业实现两位数高速增长的少数几个国家之一。”